In the wake of the global energy market disruptions caused by Russia’s invasion of Ukraine, the European Commission adopted the REPowerEU Plan in May 2022. It aims to rapidly reduce the EU’s dependence on Russian fossil fuels, by fast-forwarding the clean transition and joining forces to achieve a more resilient energy system with a true Energy Union.

To date, the EU has successfully met most of the REPowerEU Plan's ambitious targets and is on good track to achieve the medium to longer-term objectives. Over the past 2 years, it has helped the EU save energy, diversify its supplies, produce clean energy and smartly combine investments and reforms.

This report is accompanied by 27 fact sheets – one per EU country – providing a detailed country-specific analysis.

Save energy

One of the main objectives of the REPowerEU Plan is to save energy and enhance energy efficiency. This is because the cleanest and cheapest energy is the energy we do not use.

The EU has therefore taken firm actions to lower overall gas consumption as a means to rapidly reduce dependence on Russian imports.

Reducing gas demand

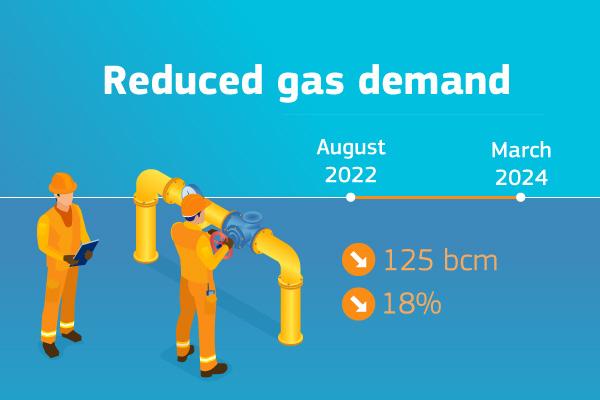

Thanks to the actions of citizens, businesses and EU countries alike, the EU has overachieved its voluntary target of reducing gas demand by 15% as established by the emergency Regulation on Coordinated Demand Reduction Measures for Gas. Natural gas demand declined by 18% between August 2022 and March 2024, saving an impressive 125 billion cubic meters (bcm) of gas.

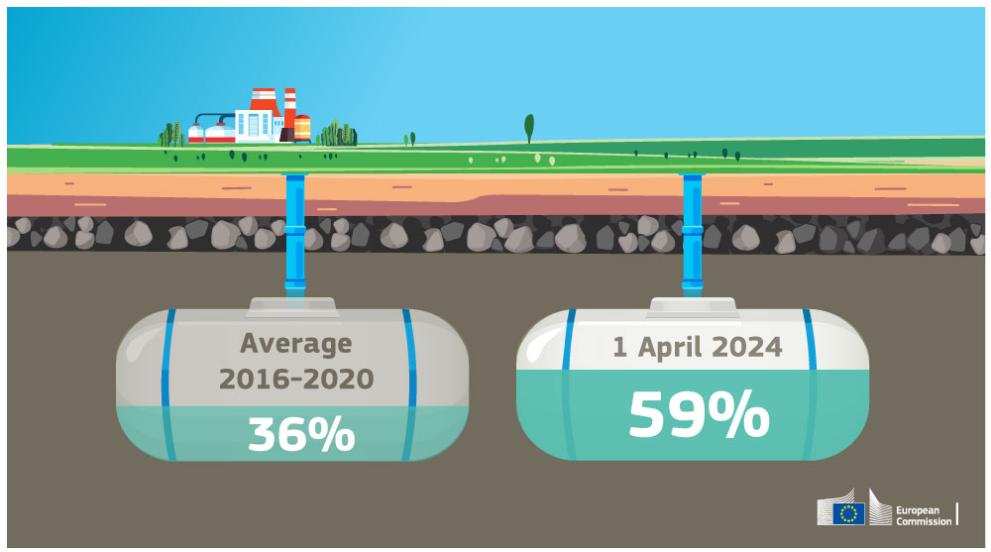

This significant reduction in gas consumption also helped ensure sufficient gas storage filling levels to avoid blackouts and power shortages. In 2023, the EU reached its 90% storage target set in the Gas Storage Regulation already by mid-August, almost 2.5 months ahead of the deadline. As of 1 April 2024, gas storage levels were at 59% capacity, a record for the close of the winter season.

The findings of a Commission report reviewing the Gas Demand Reduction Regulation and the second report on the EU's Gas Storage Regulation show that both measures have contributed to stabilising energy prices, benefitting the competitiveness of the EU economy. While retail gas and electricity prices are still above pre-crisis levels, they have declined substantially compared to the peaks in 2022.

Still, given the persistence of geopolitical tensions and tight global gas markets, a Council Recommendation on Continued Gas Demand Reduction Measures was adopted in March 2024, encouraging EU countries to continue reducing their gas consumption until 31 March 2025.

Energy efficiency

A revision of the Energy Efficiency Directive in September 2023, brought increased ambition for EU countries to collectively ensure an additional 11.7% binding reduction in energy consumption by 2030, compared to the projections of the EU reference scenario 2020. Co-legislators have also agreed on a recast Energy Performance of Buildings Directive to boost renovations and the energy performance of buildings by 2030.

In 2022, final energy consumption (FEC) decreased to 940 million tonnes of oil equivalent (Mtoe), representing a -2.8% reduction compared with 2021. Although this significant reduction was achieved in a period of exceptionally high energy prices, it points to progress in the right direction towards the achievement of the EU’s energy efficiency targets.

To further support EU countries' efforts, in December 2023 the European Energy Efficiency Financing Coalition was launched, with the objective of mobilising private investments and enhancing market uptake of energy efficiency.

Despite the significant progress made, additional efforts will be needed to be on track towards the EU’s increased 2030 energy efficiency target, including a swift and full transposition of the updated legislative framework in EU countries. To this end, the Commission is working on recommendations to ease EU countries’ incorporation of the recast Energy Efficiency Directive into national frameworks.

Examples of 'Save Energy' Actions in EU countries

26 EU countries have included investments in energy efficiency in their Recovery and Resilience Plans (RRPs).

- France supports the energy renovation of 1 750 000 households, 40 000 social housing units, and 5 000 small and very small enterprises. It further supports the thermal renovation of over 6 750 public-sites, over 28 million m2 of state-owned public buildings, and more than 680 schools.

- Austria is combating energy poverty by allocating support to the thermal renovation of 1 079 dwellings, at least 375 projects for the connection to high-efficiency district heating and at least 15 roof and façade greening projects.

- Greece aims to improve the energy efficiency of 11 500 residences, of which at least 2 300 are for energy-poor households. It also supports the installation of 171 700 solar water heating systems and heat pumps for households, of which 34 000 are for energy-poor households.

Diversify energy supplies

Since the adoption of the REPowerEU Plan, the EU has drastically phased down Russian fossil fuel imports and successfully diversified its energy supplies.

Fossil fuel imports

EU sanctions have banned seaborne imports of Russian crude oil and refined petroleum products as well as Russian coal.

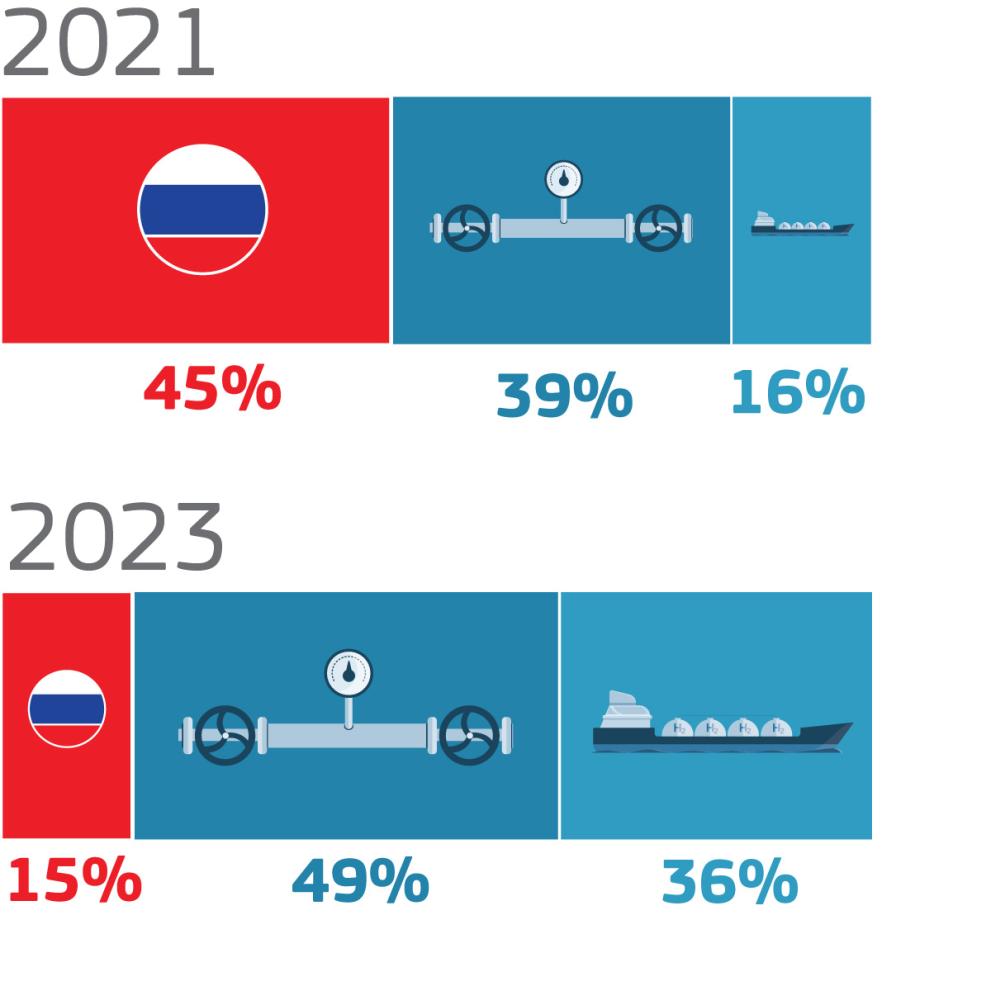

Imports of Russian gas (pipeline & LNG) dropped from a 45% share of overall EU imports in 2021, to only 15% in 2023. These are significant achievements, setting the EU on track to phase out imports of Russian fossil fuels as soon as possible.

To compensate, the EU replaced Russian gas supply with imports from other international suppliers. Norway and the U.S. have become the EU's largest gas suppliers, providing 34% and 20% of EU gas imports respectively in March 2024.

EU Energy platform and AggregateEU

The Commission established the EU Energy Platform in December 2022 with the objectives of

- facilitating demand aggregation and joint purchasing of gas

- ensuring the most efficient use of existing infrastructure

- supporting international outreach efforts

In April 2023, the Commission launched the demand aggregation and joint purchasing mechanism 'AggregateEU'. The 5 short-term rounds organised under the platform to date have matched more than 43 billion cubic meters (bcm) of gas to cover the EU’s demand. Building on this success, AggregateEU was extended under the ‘Solidarity Regulation’ and incorporated as a permanent voluntary tool under the hydrogen and decarbonised gas market package.

Energy infrastructure development

EU countries have taken significant actions to optimise existing energy infrastructure, for example by putting into operation, or updating, cross-border interconnections allowing gas to flow to where it is needed.

To accompany the increase of liquified natural gas (LNG) supply to Europe, EU countries made major infrastructure investments: a record 7 new LNG terminal projects have been commissioned over the past 2 years. They have increased the EU’s LNG import capacity to 50 bcm per year as of May 2024. This capacity is expected to reach 70 bcm by the end of 2024.

The first Union list of Projects of Common Interest (PCIs) and of Projects of Mutual Interest (PMIs) was adopted by the Commission in November 2023 to help build an infrastructure network across Europe that is fit for a decarbonised future. The list features among others

- 85 electricity projects, including 5 smart grids projects and 12 offshore infrastructure projects

- 64 hydrogen and electrolysers projects

- 14 CO2 network projects

- 10 PMIs, including electricity interconnections with the United Kingdom, the Western Balkans and North African countries

2 calls for proposals for financing from the Connecting Europe Facility for Energy (in 2022 and 2023) have been designed with the REPowerEU objectives in focus. Through these calls, the Commission awarded €1.2 billion to cross-border electricity projects ranging from projects to facilitate the integration of renewable electricity, to natural gas storage projects in South-Eastern Europe, and projects establishing the first building blocks of a future Europe-wide CO2 value chain.

Concrete actions to support infrastructure development in the EU

21 EU countries have included investments in energy infrastructure in their Recovery and Resilience Plans, supporting the REPowerEU objectives.

- Belgium’s RRP supports the construction of an artificial energy island in the North Sea. This offshore energy hub has 2 objectives: to connect at least 3.15 GW of future offshore wind energy to the onshore electricity grid, and to facilitate the integration and import of more renewable energy from the North Sea by connecting to other countries.

- Italy will improve the resilience of at least 4 648 km of power grid, with Recovery and Resilience Facility support. In addition, 514 km of submarine cables between Eboli and Caracoli and the ‘East interconnection line’ between Sicily and Campania will be constructed to integrate renewables from the south.

- Poland will construct or modernise 880 km of electricity distribution networks in rural areas, including the necessary stations and integrating smart grid functionalities, to enable the connection of new renewable energy sources in these areas.

EU countries RRP’s also include targeted support to gas infrastructure and facilities to meet immediate security of supply needs and help diversify away from Russian fossil fuels. In particular, this refers to the following 3 projects (receiving €1.6 billion in total): increasing the capacity of the Krk LNG terminal and developing related gas infrastructure towards Hungary and Slovenia (Croatia), the Adriatic Line infrastructure (Italy) and the network between Gdańsk and Gustorzyn (Poland).

Enhanced international cooperation

The Commission has continued to strengthen international partnerships and approach non-Russian suppliers to secure more reliable imports of gas, and increasingly hydrogen.

As part of this effort, the EU has signed a series of Memoranda of Understanding (MoU) with neighbouring countries (Morocco, Egypt, Norway, Ukraine) and others (Azerbaijan, Kazakhstan, Namibia, Japan, Argentina and Uruguay). A Strategic Partnership with Ukraine on renewable gases was established and the 'EU–Ukraine Strategic Partnership on Biomethane, Hydrogen and other Synthetic Gases' MoU was signed in February 2023 at 24th EU–Ukraine Summit in Kyiv.

Produce clean energy

REPowerEU puts the accelerated production of clean energy at the centre of efforts to enhance the EU’s energy security and ensure the decarbonisation of our economy.

The EU has increased its production of energy from renewable sources beyond expectations. In 2022, the EU generated more electricity from wind and solar than from gas and in 2023, wind alone produced more electricity than gas.

In October 2023, the EU agreed on stronger legislation to increase its renewables share in the context of the revised Renewable Energy Directive, raising the EU’s binding target for 2030 to at least 42.5%, with the ambition to reach 45%.

Industry estimates indicate that installed wind and solar capacity has increased by 36% cumulatively between 2021 and 2023, saving approximately 24 billion cubic meters (bcm) of gas over 2 years.

In 2024, estimates indicate that installed capacity could further increase by 16%, displacing approximately 15 additional bcm of gas.

Solar energy

With 56 GW of new solar energy capacity installed in 2023 (according to SolarPower Europe), the EU has set yet another record from the additional 40 GW installed in 2022. While these are impressive figures, further acceleration is still needed to meet the REPowerEU targets under the EU Solar Energy Strategy and bring online at least 700 GW by 2030, up from the estimated 260 GW installed to date.

Key facts on EU solar capacity

The EU Solar Energy Strategy includes 3 flagship initiatives

- European Solar Rooftop Initiative, to tap into the potential of rooftops to produce clean energy

- EU Large-Scale Renewable Energy Skills Partnership, launched in March 2023 to create new green jobs and support the development of a skilled work force

- EU Solar PV Industry Alliance, launched in December 2022 to diversify imports of solar components and expand solar PV manufacturing in the EU

The European Solar Charter, signed by the Commission, 23 EU countries and solar industry representatives in April 2024, sets out a series of voluntary actions to further support the EU’s photovoltaic industry.

Examples of flagship reforms to accelerate the deployment of renewables

24 EU countries include investments and reforms in their Recovery and Resilience Plans in line with the REPowerEU objective to produce clean energy.

- Estonia is strengthening the capacity-building of local permitting authorities. It also aims to increase the production and uptake of sustainable biogas and biomethane, with a target to install at least 4 million cubic meters of new sustainable biomethane production capacity.

- Denmark supports the replacement of at least 21 200 oil burners and gas furnaces with heat pumps or district heating.

- Poland will facilitate deploying onshore wind energy by allowing wind power plants to be located closer to residential buildings.

- Portugal eases permit-granting procedures and designates renewables acceleration areas. It supports the installation of 143.5 MW of renewable energy production capacity connected to the electricity grid.

- Czechia and Hungary aim to specifically improve the predictability, transparency and availability of grid connection.

Some Recovery and Resilience Plans also include investments to support the deployment of the hydrogen value chain (as long as it is derived from renewable energy sources or meets a greenhouse gas emission reduction threshold of 70% compared to fossil-based hydrogen), for example

- Spain and Germany finance respectively 700 MW and 300 MW of electrolyser capacity to produce renewable hydrogen.

Wind power

As for wind power, 17 GW of new capacity was installed in the EU in 2023, amounting to a total 221 GW, up from 188 GW in 2021 (according to Wind Europe estimates). While this shows impressive progress, the wind sector needs to be boosted further to meet the EU's ambitious renewable energy targets. To this end, the Commission adopted a Wind Power Package in October 2023.

EU wind generation capacity

Comprising an Action Plan and a Communication on delivering the EU offshore renewable energy ambition, the package represents the Commission’s response to the unique set of challenges facing the European wind sector, including insufficient and uncertain demand, slow and complex permitting, increasing global competition and unsupportive design of national auctions. The action plan sets out several concrete measures, including the launch of the ‘Accele-RES initiative’ focusing on the digitalisation of permitting processes and technical assistance to EU countries.

In addition, as a follow up to the Action Plan, in December 2023, 26 EU countries together with leading industry representatives signed the European Wind Charter, setting out voluntary commitments to support the development of Europe’s wind sector. At the same occasion, 21 EU countries submitted their concrete pledges on wind energy deployment volumes for at least the period 2024-2026.

Heat pumps

The heat pump market saw an exceptional growth in 2022, with sales of all heat pumps for space heating (hydronic and air-to-air) reaching 2.75 million. In 2023, the market slightly decreased to about 2.5 million units sold.

To meet the number of heat pumps required to achieve the 2030 climate target, the EU needs to more than double the annual rate of deployment, rolling out close to 6 million new heat pumps (hydronic and air-to-air) each year from 2025 onwards.

The Commission undertook extensive preparatory work on a Heat Pump Action Plan in 2023 and will be funding the launch of a Heat Pump Accelerator Platform to monitor and assess the development of a supportive and coherent policy framework in EU countries.

Permitting procedures, auctions and acceleration areas

On top of these sector-specific actions, the Commission adopted a proposal in November 2023 to prolong certain emergency measures on permitting, aimed at shortening and accelerating the permit-granting procedures for renewable energy projects. The proposal was agreed by the Council in December 2023. In addition, the Commission published an Action Plan for Grids to address the main challenges in expanding, digitalising and better using EU electricity transmission and distribution grids.

In May 2024, a new 'package' was adopted, including 3 targeted measures to further accelerate the deployment of renewables in the EU

- a Commission Recommendation and guidance on the design of renewable energy auctions

- an updated Recommendation and guidance on speeding up permit-granting procedures for renewable energy projects

- a guidance on designating renewables acceleration areas

To enhance visibility and predictability for the whole value chain, a EU-wide renewables auctions platform was launched as part of the package, consolidating information on planned renewable energy auctions in all EU countries.

Renewable gases

Tackling cross-sectoral issues that impact all renewables will also help foster the ramp-up of renewable gases.

Biomethane and biogas production is increasing at an impressive pace, contributing to achieving the REPowerEU target of producing 35 billion cubic meters (bcm) per year by 2030. Based on the ambitions and projections in EU countries’ draft updated National Energy and Climate Plans, biogas and biomethane production would reach a cumulative range of 30-32 bcm by 2030. Industry reports €18 billion investment mobilisation by February 2024.

As for hydrogen, EU legislators completed the legislative framework to enable this emerging market. The first off-take agreements for renewable hydrogen have been signed, electrolyser manufacturing capacity has rapidly expanded, the first large-scale hydrogen production facilities (200 MW) are under construction, and the necessary infrastructure is already being planned by future hydrogen network operators.

Smartly combine investments and reforms

The implementation of the REPowerEU Plan has required massive investments and reforms. Close to €300 billion has been mobilised at the service of the EU countries. The Recovery and Resilience Facility (RRF) has been at the heart of this effort, as the main vehicle channelling EU funding to the implementation of REPowerEU.

The amended RRF Regulation was adopted in February 2023, making available to EU countries an additional €20 billion in REPowerEU grants from the auctioning of allowances of the Emissions Trading System, complementing the €225 billion of loans that remained available under the RRF at that time. The RRF Regulation also foresees the possibility of voluntary transfers from other EU funds for a total of approximately €52 billion.

So far, the REPowerEU chapters of 23 EU countries have been approved as part of their revised Recovery and Resilience Plans.

Overall, more than 42% (€275 billion) of committed RRF funds will contribute to climate objectives, and more than €184 billion is supporting energy-related measures.

In addition to the Recovery and Resilience Facility, REPowerEU priorities are eligible for funding through a number of EU programs, including the Connecting Europe Facility (CEF) Energy, LIFE Clean Energy Transition, European Structural and Investment Funds, the Just Transition Fund, Horizon Europe, InvestEU and the Innovation Fund.